By Leslie Willcocks, Gero Gunkel and Mary Lacity

Intelligent automation, Artificial Intelligence (AI) and cognitive automation have become amongst the most hyped and misused terms in business. Sidestepping debates, our own definition of cognitive automation is: “A software tool that analyzes unstructured and structured data using inference-based algorithms to produce probabilistic outcomes.” At Zurich Insurance, Blue Prism RPA software had been already applied to several insurance processes. These processes exhibited the typical attributes for successful RPA deployment – namely structured data; manual (screen-based) and repetitive rules-based activities; high volumes; and mature, stabilized processes that required definitive outcomes. Subsequently Zurich sought partly to see how far cognitive automation could complement and enhance RPA usage, but more importantly, to build learning and a platform for future automation tools and their application for strategic business purpose.

Founded in 1872, Zurich Insurance Group Ltd is a leading multi-line insurer, with headquarters in Zürich, Switzerland. Zurich recognized the need to become more customer focused organisation, and has invested strongly in digital capabilities; simplifying products and processes; providing customer self-service; investing in technology, systems and skills; and upgrading the flexibility, quality and value of shared services. Automation figured highly in most of these forward plans and actions. In underwriting, Zurich had already adopted automation of straight-through flow underwriting and cognitive computing in Germany, UK and Switzerland, and was rolling this out in Spain and Italy by 2018. Predictive analytics were being used to improve risk retention decisions in crop insurance. In claims, robotics were being used in production in three countries, and this was set to be rolled out for all core markets by 2019. Likewise straight through claims processing (or ‘one-and-done’) was being increased from 20% to 40% of all claims by 2019. Meanwhile predictive analytics in four countries would be rolled out globally by 2019, to reduce claims costs and shorten time to close. Enhanced automation of claims processes would also improve the customer experience, as well as functional effectiveness. Here we look at a particular example of this – improving injury claims efficiency and efficacy through cognitive automation.

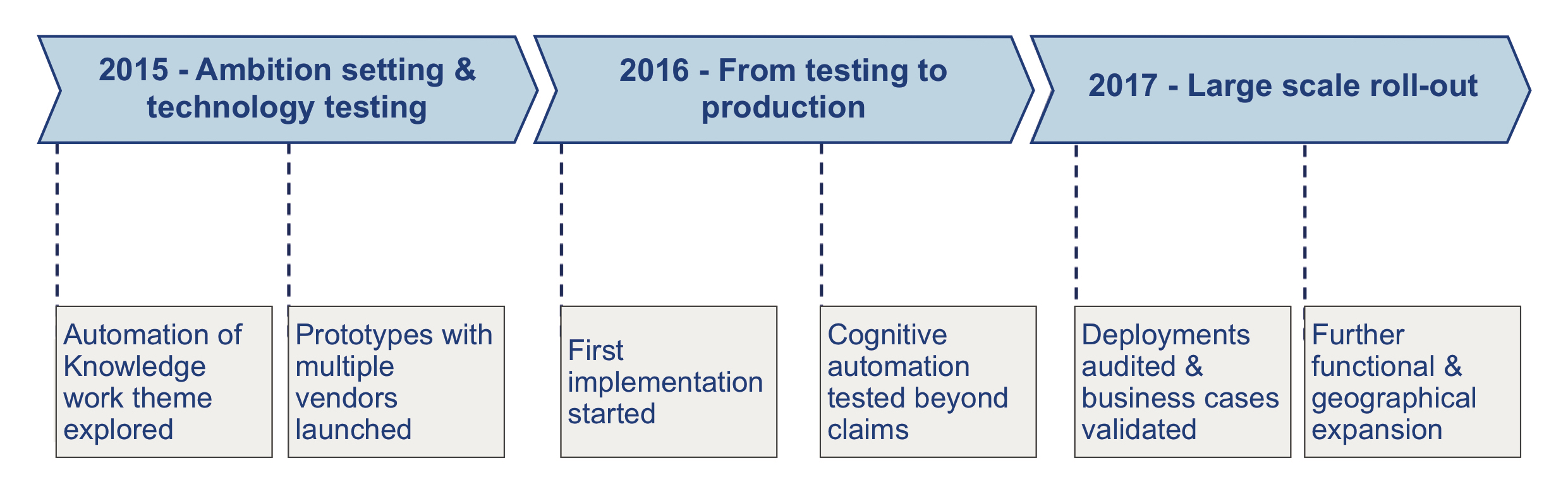

Key technology trends were explored as part of the revision of Zurich`s Technology & Operations strategy through late 2014 and early 2015. One of those trends was the ‘Automation of Knowledge work’, given the advances in computing power and the exponential growth of data. Zurich wanted to test how mature intelligent automation systems were and, thus, decided to run a portfolio of prototypes to test these solutions. The timeline for CA deployment is shown in Figure 1.

Figure 1. Zurich Timeline for CA

For the first prototype Zurich selected a claims valuation process for personal injury claims. Here, claims handlers review medical reports that are submitted by a claimant to decide on compensation value for pain and suffering. The process was selected for two reasons: firstly, it is a representative insurance process/activity; and secondly, it is quite a complex and demanding activity with claims handlers requiring significant training to perform this task effectively. According to Richard Wood, Senior Transformation manager at Zurich Insurance, the thinking here was: “If we can automate the evaluation of medical reports, it proves we can automate a significant part of today`s processes and activities across the whole insurance value chain.” It was time to test CA with a live process.

Time and motion studies highlighted that reading the report was time consuming and that a combination of robotic process automation and cognitive automation software could greatly enhance execution:

“The key here is the use of multiple intelligent automation technologies working together to solve a complex business process. Our cognitive tool is used to understand and extract injury details, prognosis and key data from a medical report and supporting documentation. It is then passed to our RPA tool which interacts with other tools and techniques to value the injury.”

Adam Briggs, Claims Automation Manager. Zurich Insurance UK

Zurich used a combination of Blue Prism RPA and Expert System CA software to reduce the time to handle a claim from 59 minutes to five seconds. The robots were available 24x7. A high reduction in leakage resulted from standardized decision-making. Zurich saved $5 million a year from 2017, gave customers a faster service, and freed up 39,000 hours per year of labour capacity. After this very promising start, by early 2018, Zurich had several cognitive automation projects in production in multiple areas of the business.

In the Zurich Insurance chapter in our 2018 book – Robotic Process and Cognitive Automation: The Next Phase - we identify many lessons for practitioners. Here are some of the more notable ones:

- 1. Make business strategy drive technology investments. Zurich Insurance started looking at cognitive automation in the context of broader strategic business issues and decisions.

- 2. Don`t look for a ‘Swiss army knife’. Competitive advantage is not derived from the selection of one technology or service vendor, but through the ability to identify and connect different technologies that maximize the full potential of modern automation technologies.

- 3. Create a new process flow. Cognitive automation is often not about automating the existing process, but more about creating a new process flow that fits the machine. Hence, the need to move from a human centric process flow to a machine centric process flow.

- 4. It's a lot more work than you think – set realistic expectations. The media can be highly misleading about cognitive automation capabilities, and frequently underplays the amount of work it requires to get tools to perform proficiently. Zurich Insurance’s experiences reinforce those we found at KPMG, SEB Bank, Deakin University and Standard Bank of South Africa. In particular, it is clear that cognitive automation tools are not, as at 2017, ‘plug and play’ in the sorts of organisational contexts we are examining.

- 5. Integrate service automation programs - expect to increasingly use robotic process automation and cognitive automation tools in complementary ways. At Zurich, the CA tool is embedded into a RPA process flow. More broadly, in the automation services market, we are increasingly seeing tools providers offering both RPA and CA capabilities, while some are also developing platforms that enable the use of different tools sets.

You can read more about this case and many others in our new book – Robotic and Process Automation: The Next Phase – available from www.sbpublishing.org.