By Leslie Willcocks and Mary Lacity

In February 2018 we conducted a survey of clients attending the IAOP Outsourcing World Summit in Orlando Florida. The results in terms of extent of deployment and levels of business value appear in an earlier blog article (Robotic and Cognitive Automation 2018 Update (1): Client Deployments and Business Value).

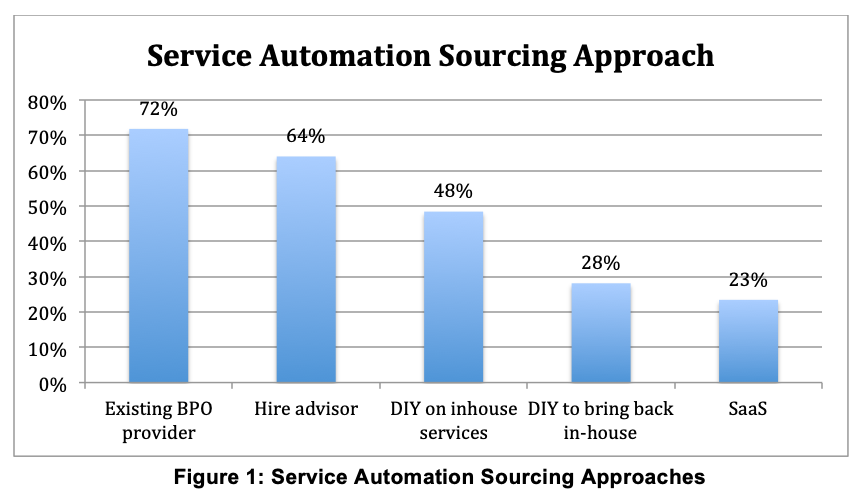

We also asked clients which sourcing approach they typically used for service automation programs. Clients most commonly reported that they relied on their current service providers to automate services for them (see Figure 1). This is good news for business and IT service providers that have developed significant automation capabilities. For clients, the benefits of engaging a traditional provider include a full suite of integrated services that combine labour arbitrage, process excellence, change management maturity and technology expertise. The downside is provider-lock in. If a client wants to switch providers, it may find it needs to recreate the automations with the new provider.

Advisors will also be pleased to learn that 64 percent of clients said they hire advisors to help with service automation. In the past few years, we have seen advisors quickly building service automation practices in response to increased client demand. Advisory firms track the service automation landscape and help clients with their service automation journeys. Credible advisors need to master a variety of tools to be ‘tool agnostic’ and they must understand which tools are best suited to meet a client’s needs. Advisors are building capabilities by a variety of means. These include: adopting tools to automate their own internal services, hiring pioneers from early enterprise adopters, and sending analysts through the software provider’s training certification programs.

Nearly half of clients also manage some automation programs themselves, without outside help from providers or advisors. With insourcing, client organizations bear all the risks of service automation themselves, but earn all the benefits – if managed well. For this ‘do-it-yourself’ (DIY) model to pay off, clients need to invest significant resources in building internal service automation skills.

A smaller percentage of client organizations use service automation to bring services back in-house (28 percent) or are beginning to buy automations as a service – SaaS – at 23 percent. Both of these percentages are double last year’s figures. Ian Barkin, Chief Strategy Officer for Symphony Ventures, sees these trends as related:

“Technology has evolved quickly, but organizational change and contract timelines prevent similar paces in operations. However, several years into RPA, we’re seeing interesting behaviors surfacing. First, free agent status is spreading as five and seven-year BPO contracts are coming due. Firms are liberated to consider their options – and they have so many new and interesting options! Second, firms are repatriating because ‘cheap’ was compelling, but they now know there’s more to value than just lower cost – they are looking to bring work back, closer to the core, and automation makes that possible. Third, comfort with the cloud is bedding in.”

The SaaS model is a particularly interesting trend to watch, as increasingly clients are interested in hiring providers to ‘manage robots’, typically with three year SaaS contracts. Clients like the ‘pay-as-you-use’ model of a virtual workforce. Ian Barkin continued, “SaaS is not just for Customer Relationship Management (CRM) anymore. Increasingly, firms are looking to migrate to a ‘Digital Operation’ that is integrated, orchestrated, and innovated on their behalf. This perfect storm of free agency, value realignment and comfort with SaaS models promises to have truly profound effects on how work is done.”

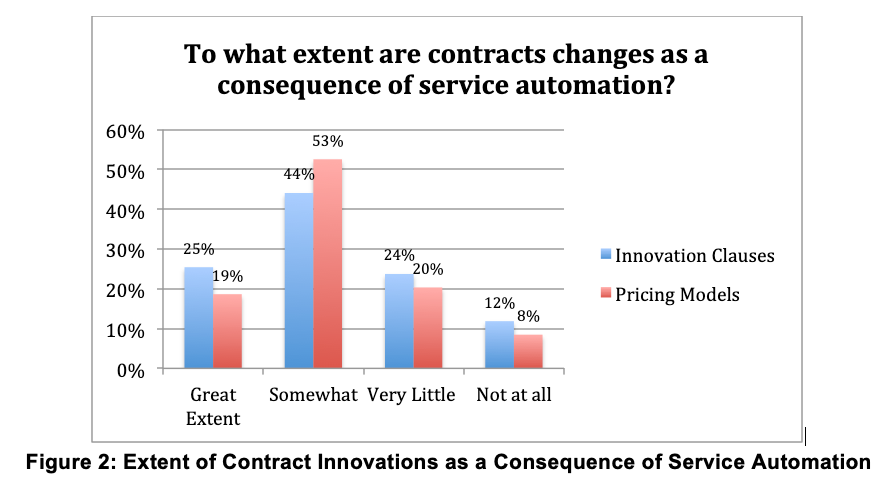

We also asked clients the extent to which their contracts were changing to keep pace with advances in automation. Specifically we asked whether innovation clauses or pricing models were different as a direct consequence of service automation. Overall, the majority of clients reported that contracts were being changed ‘somewhat’ (see Figure 2).

A quarter of the clients reported that they were substantially revising their innovation clauses because of service automation. The aim is to create an innovation incentive where both sides benefit from the value. Only 19 percent reported changing their pricing models to a great extent. No matter how much clients, providers, and advisors agree that FTE rate cards are a poor pricing model, their stickiness pervades. FTE rate cards are indeed the simplest way to size a service, but as an input metric, it does little to capture the real value delivered by services. As a community, we have long debated the metrics of other pricing models, but we suggest more rapid progress is needed in this area.

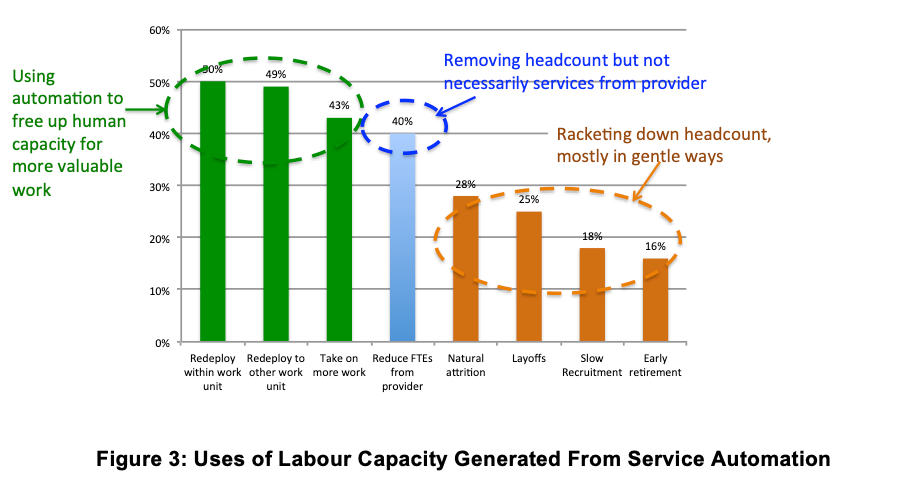

Does service automation lead to massive layoffs? On the OWS 2018 survey, we asked respondents, “What does your organisation do with the FTE savings generated from automation?” (see Figure 3). The most common responses were: redeploying employees within the unit (50 percent); redeploying employees to other work units within the company (49 percent); and taking on more work without adding more people. These three common uses indicate that service automation is being used to create excess human capacity to focus on more value added work. We call this ‘using service automation to take the ‘robot’ out of the human’. Across multiple case studies, we found organisations automating the dreary and repetitive tasks so that employees can focus on what they were better hired to do, like solve problems, think creatively, and build relationships.

Forty percent of clients also use service automation to reduce the number of provider FTEs servicing their accounts. As we saw in the previous section, many clients rely on their service providers to improve services using automation technologies, so the reduction in provider FTE headcount does not indicate a decline of outsourcing for most client organisations. Instead, it means that service providers have made significant investments in automations that allow them to provide services to clients with fewer people.

Finally, as organisations start scaling their automations, they may need fewer people. Indeed some 25 percent of clients report layoffs as a result of automation. However, the preferred methods are a gentle racketing down of headcounts through natural attrition, by slowing recruiting, or by offering early retirements.

By 2018 RPA and CA had reached interesting stages. The RPA market is likely to expand by at least 38 percent compound annual growth over the next five years, while cognitive automation deployments are still immature and much fewer in number, but forecast to start taking off at the back end of 2018. Meanwhile, though high in the headlines, practical examples of real Artificial Intelligence (‘AI’) - ‘getting computers to do what minds can do’ - are notably absent from the vast majority of our workplaces, globally. All this is likely to change over the next two years, and so we will continue to regularly monitor and comment on developments with client and providers across that period.

You can read more about deployments of RPA and CA, the results gained and how these are secured in our latest book – Robotic Process and Cognitive Automation: The Next Phase – available from www.sbpublishing.org.